Estate Planning

Estate Planning is an important part of financial planning. It is

necessary to have an estate plan in place so that your wealth is

transferred to intended beneficiaries without hassles. It is not a

simple process and therefore enlisting the help of a financial planner

or a professional will help you in getting it right.

Estate means the net worth of a person. Estate planning refers to making

arrangements such that your wealth is taken care of and distributed to

beneficiaries, as you desire after your death without too many legal

hassles. It is an important aspect of personal finance and financial

planning, irrespective of how big or small your net worth is in your

opinion. It is better to take professional assistance for estate

planning, as it is a tough task. Here are some guidelines.

Creating a will: It is important to draft a will. The will should state

the wealth that you have and how it should be divided between your

beneficiaries. It should also contain information about how donations

should be taken care of. It can be either handwritten, in a computer

file or there are even online services that can draft your will. It is

important to name a person who will execute the will when you are not

there. You should sign the will in the presence of witnesses. For more

information on creating a will, you can read our article by clicking

here.

Setting up a Trust: The other way to secure the transfer of one’s net

worth as desired is to set up a trust. This is normally done when the

intended beneficiaries of the estate are not ready to take up the

responsibility. The trust will take care of the estate and when the

beneficiaries are ready to take up the estate, it will be handed over to

them.

Division of assets and liabilities among heirs: Estate Planning involves

listing down legal heirs who may not necessarily be relatives and

detailing out who gets which part of the estate. Documentation of this

aspect is important so that there is no confusion on who gets what.

Nominating a guardian for dependents: If you have any dependents, the

estate plan should state how they should be taken care of in your

absence. The plan should highlight who should be responsible for the

dependents. For example, if you are taking care of disabled relatives,

you should detail out how they should be taken care of when you are not

there.

Financial Planning: As you know, financial planning is an ongoing

exercise, it is important to have a broad outline of steps in place so

that the ones taking care of your finances and do what is required to

reach the financial goals set.

Review your estate plan: It is important to review/update the plan once

in a while. Some reasons which could mean an update to the estate plan –

Value of net worth changes.

our relationships changes like you have a child

or you remarry.

Laws related to estate planning change.

It is important to have an estate plan in place. Otherwise the estate

would be given to legal heirs, as per the existing laws of the state,

and not in the manner you had in mind. It has to be in place so that

there are no complications on how your wealth should be distributed

after your death.

Tax Planning

What Is Tax Planning?

Tax planning is a method by which one studies and avails of the

deductions, exclusions, allowances and exemptions provided to him by the

Government of India to save on his income tax. One needs to know which

income tax slab he falls under. A careful study of the deductions

available needs to be made and only those availed which makes one

comfortable.

One needs to make time an ally and start planning for his taxes as early

as possible and not wait until it is too late.

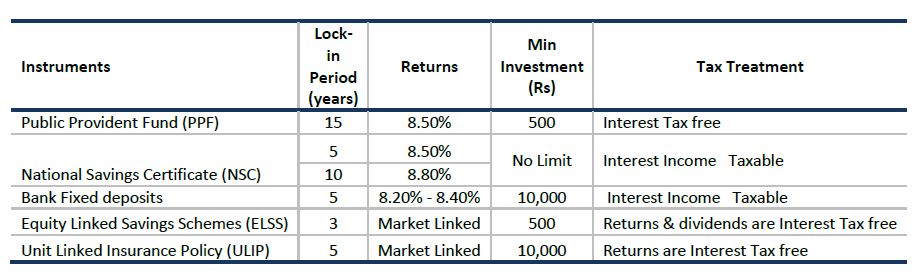

Comfort in tax planning basically depends on ones capacity to bear or

tolerate risk. If one has a conservative bent of mind and is averse to

taking risks he must make use of fixed income securities where the

principle is not at risk. If one has a higher tolerance towards risk

then equity linked savings schemes are the way to go.

The time horizon also plays a very important role in determining one's

ability to bear risk. If one is older and around 50 years of age a

public provident fund which has 15 years as a minimum lock in period for

the amount invested might not be suitable. If one is young and has a lot

of time on his side to invest known as a long term horizon then an

aggressive instrument such as equity linked savings scheme is an apt

choice.

Tax planning needs to be flexible and not set in stone. It is an ongoing

or a dynamic pro cess which has to be tweaked according to ones need. It

is a sound test of one's decision making ability.

It involves research and a study of a change in the income tax laws and

their impact on ones tax liability.

The final decision in tax planning is the calculation of one's income

tax liability based on the income tax slab he falls under and a

judicious selection of the right avenue to save income taxes based on

the risk tolerance.

In order to encourage savings, the government gives tax breaks on

certain

financial products under Section 80C of the Income Tax Act. Investments

made under

such schemes are referred to as 80C investments.

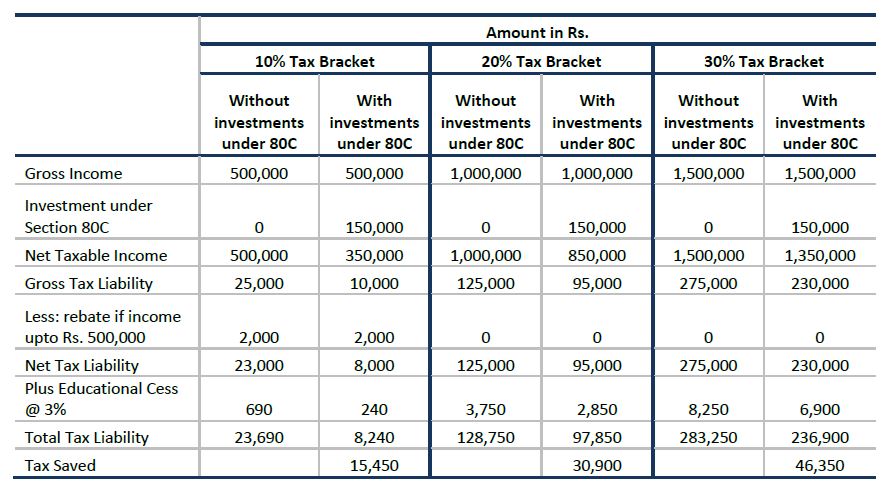

Section 80C of the Income Tax Act, 1961 allows certain investments and

expenditure up to the maximum of Rs. 150,000/- to be deducted from total

income for tax computation of the current Financial Year and if you are

in the highest tax bracket of 30%, you save a tax of Rs 46,350/- as

illustrated in the table below:

Features of SECTION 80C:

The deduction under section 80C is from your

Gross Total Income

Available to an Individual or a HUF

The limit of deduction for current financial year

is Rs 150,000

It is available to everyone, irrespective of his

or her income levels

The various investment options under this section include:

Provident Fund (PF) & Voluntary Provident Fund (VPF):

PF and VPF is deducted directly from your salary by your

employer.

Public Provident Fund:

An account can be opened with a nationalized bank or Post

Office.

National Savings Certificate:

These are 6-years small-savings instrument, where the rate of

interest

is 8% and is compounded half-yearly.

Equity-Linked Savings Scheme (ELSS):

Mutual funds offer you specially-created tax saving schemes

called ELSS.

Home Loan Principal Repayment:

The principal component of the EMI qualifies for deduction under

Section 80C.

Stamp Duty and Registration Charges for Home:

The amount you pay as stamp duty when you buy

a house and the amount you pay for the registration of the

documents of the house can be claimed

as deduction under section 80C.

Five-Year Bank fixed deposits:

Tax-saving fixed deposits (FDs) of scheduled banks with a tenure

of

five years are also entitled for section 80C deduction.

Others:

Apart from the above, things like children's education expenses

that can be claimed as

deductions under Section 80C. However, you need receipts to

claim the same.

Tax planning should not only be aimed at saving taxes but also to aid

your investments to help you

achieve your financial goals. While there are many schemes that are

offered to save taxes, ELSS can be

used to save taxes as well as for wealth generation as it invests

heavily in Equities to ensure the desired

long term yields.

Disclaimer

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

@ Tax benefits are subject to the provisions of the Income Tax Act, 1961 and are subject to amendments, from time to time.

Certain information contained in this document is compiled from third

party sources. Whilst Mirae Asset

Global Investments (India) Private Limited has to the best of its

endeavor ensured that such information

is accurate, complete and up-to-date, and has taken care in accurately

reproducing the information, it

shall have no responsibility or liability whatsoever for the accuracy of

such information or any use or

reliance thereof. This document shall not be deemed to constitute any

offer to sell the schemes of Mirae

Asset Mutual Fund. Mirae Asset Global Investments (India) Pvt. Ltd/

Mirae Asset Trustee Co. Pvt. Ltd./

Mirae Asset Mutual Fund/ its Directors or employees accepts no liability

for any loss or damage of any

kind resulting out of the unauthorized use of this document.

Mutual funds are subject to market risks, read all scheme related documents carefully.

Mutual funds are subject to market risks, read all scheme related documents carefully.

Why is tax planning necessary?

This is a question in the minds of all individuals of our nation and has

a simple answer. If one is rich and very generous towards the Government

then the answer is no. For those who are averse to doing so tax planning

is a must.

The main aim of tax planning is to limit the income tax liabilities by

making use of the tax deductions, exclusions and exemptions provided by

the Government to reduce the net income taxes payable. Income tax is

something none can escape. Without proper plan ning the full tax amounts

needs to be paid based on the income tax slab one falls under. With

proper tax planning one can save on the amounts which would otherwise

result.